BCG Growth-Share Matrix vs Compound Moves: Digital Portfolio Strategy for the AI Era

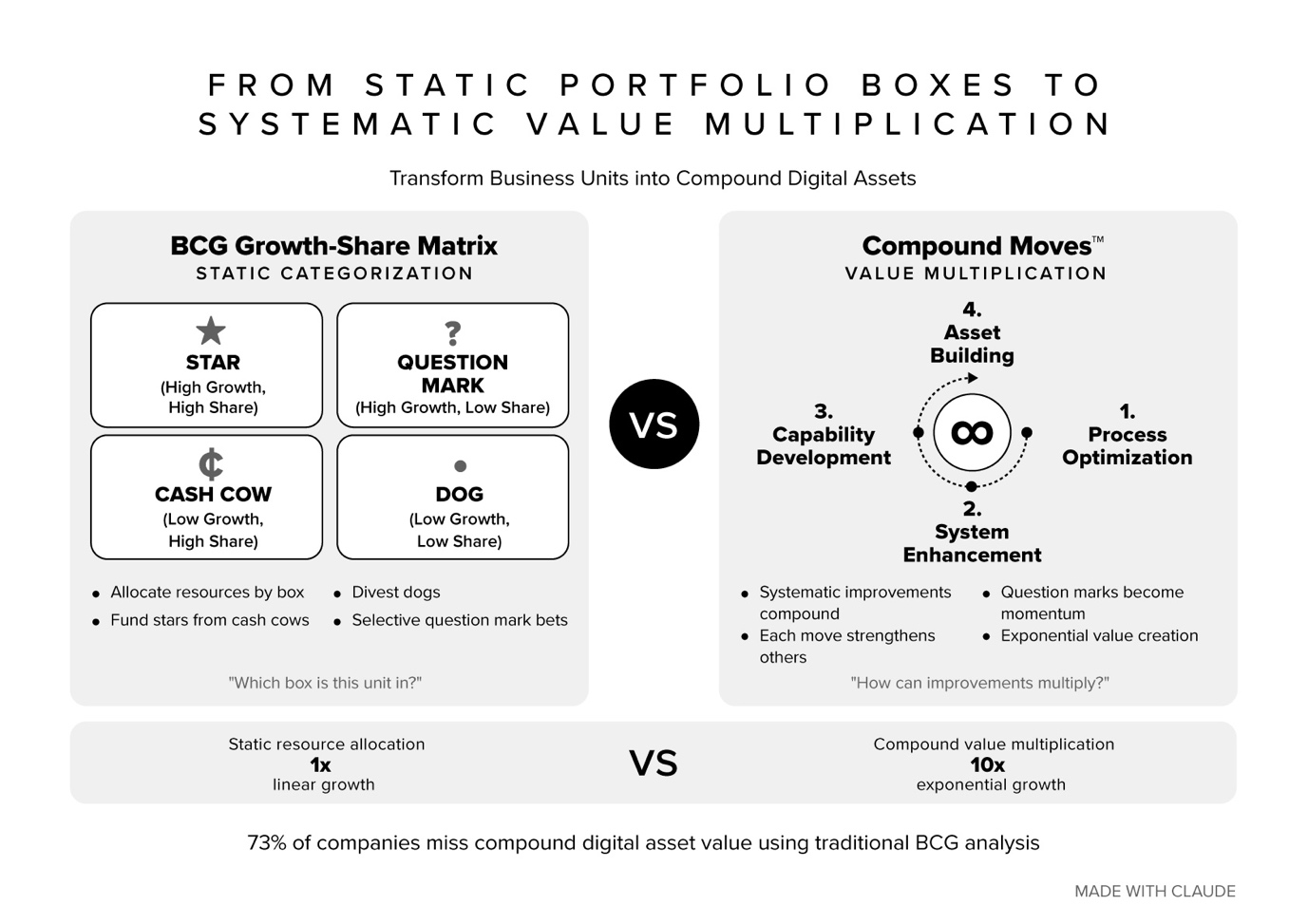

The BCG Growth-Share Matrix categorises business units into cash cow, star, dog and question-mark boxes. Compound Moves™ create systematic value multiplication by integrating process, system, capability and asset improvements.

BCG Growth-Share Matrix sorts business units into static boxes; Compound Moves™ create systematic value multiplication through digital asset architecture that transforms «question marks» into momentum creators.

Why traditional portfolio analysis misses compounding digital assets and how to build strategic value through systematic optimization

Traditional BCG Growth-Share Matrix categorizes business units into static portfolio boxes (cash cow vs star, dogs vs question marks) without recognizing how digital assets compound systematically. But effective portfolio analysis in 2025 requires understanding how Compound Moves create exponential value through systematic optimization rather than hoping portfolio boxes align.

Compound Moves replace traditional portfolio categorization with systematic value multiplication: incremental strategic actions that compound through mathematical validation and system integration, transforming «question mark» investments into momentum-generating strategic assets.

bcg matrix vs compound moves comparison graphic

The BCG Growth-Share Matrix Problem: Why Portfolio Boxes Ignore Digital Asset Compounding

Most organizations use BCG’s classic portfolio analysis to allocate resources across business units: cash cows fund growth, stars receive investment, dogs get divested, and question marks require selective betting. This box-based approach creates three critical digital-era portfolio failures:

1. Static Categories vs Dynamic Asset Evolution

Traditional BCG approach:

- Categorize business units into fixed portfolio positions

- Allocate resources based on current market share and growth rates

- Maintain portfolio balance through cash cow funding of stars

- Divest or minimize investment in dogs and uncertain question marks

Digital reality check: Portfolio boxes ignore how digital assets compound over time. A «question mark» content strategy can evolve into a massive audience asset, while a «cash cow» traditional service can become obsolete through AI disruption without systematic digital transformation.

2. Resource Allocation vs Value Multiplication

Standard BCG portfolio metrics:

- Market share percentages relative to largest competitor

- Market growth rates determining investment priority

- Cash generation capability from established business units

- Resource requirements for maintaining competitive position

Investment insight problem: BCG analysis focuses on resource allocation between separate units rather than understanding how systematic improvements create compound value across the entire portfolio through digital asset integration.

3. Business Unit Analysis vs System Integration

Traditional portfolio management:

- Individual business unit performance optimization

- Isolated investment decisions based on market position

- Competitive analysis within specific market segments

- Financial returns calculated per business unit

Digital transformation reality: Success depends on systematic value multiplication where incremental improvements create compound effects across interconnected digital assets, generating exponential returns invisible in traditional portfolio box analysis.

How BCG Growth-Share Matrix Misses Digital Asset Compounding

Research from McKinsey’s 2024 Digital Strategy report shows that 73% of companies using traditional portfolio analysis failed to recognize compound value creation from digital assets, leading to systematic underinvestment in transformation opportunities that appeared as «question marks» in BCG matrix evaluation.

Real-World BCG vs Compound Moves™ Examples

Traditional BCG Portfolio: Digital Marketing Agency (Missed Transformation)

BCG Portfolio Analysis:

- Cash Cow: Traditional PPC management (70% of revenue, stable margins)

- Star: Social media marketing (high growth, competitive market)

- Question Mark: AI implementation services (uncertain demand, high investment)

- Dog: Website design services (declining market, low margins)

Strategic Decision: Continue funding social media expansion from PPC cash flow, minimize AI investment due to question mark status, consider divesting website design

Why this misses compound value: AI implementation services aren’t just another business unit—they’re the foundation for transforming every other service through systematic capability building and market position evolution.

Compound Moves Alternative: Systematic Value Multiplication

Compound Moves Architecture:

Process Optimization Compound Move: Integrate AI tools into PPC management

- Immediate impact: 40% improvement in campaign performance

- System connection: Creates AI expertise foundation for broader application

- Value multiplication: Existing clients become early adopters for expanded AI services

- Momentum creation: Proves AI capability to enterprise prospects

Capability Development Compound Move: Train team in AI implementation frameworks

- Immediate impact: Enhanced service delivery quality across all offerings

- System connection: Builds intellectual capital for premium positioning

- Value multiplication: Creates competitive differentiation through expertise depth

- Momentum creation: Enables transition from service provider to strategic advisor

Asset Building Compound Move: Document AI transformation methodologies

- Immediate impact: Systematizes successful implementations for repeatability

- System connection: Creates proprietary IP for market positioning

- Value multiplication: Enables productized offerings and premium pricing

- Momentum creation: Transforms agency into category-defining thought leader

Why this creates exponential value: Each Compound Move strengthens the others, creating systematic momentum where AI capabilities compound across the entire business rather than existing as isolated «question mark» investment.

The Digital Asset Blindness Problem

Netflix’s Early Portfolio Evolution (2007):

- Traditional BCG view: DVD-by-mail (cash cow), streaming (question mark with uncertain ROI)

- What BCG analysis missed: Streaming wasn’t just another business unit—it was systematic transformation enabling data collection, customer behavior analysis, and content creation capabilities

Compound Moves approach would have emphasized:

- Technology infrastructure compound moves: Systematic streaming capability building

- Data asset compound moves: Customer behavior analysis creating content intelligence

- Content strategy compound moves: Original programming enabled by streaming data insights

Investment insight: Netflix’s success came from systematic compound moves that transformed streaming from «question mark» into exponential value creation through integrated digital asset development, not from traditional portfolio resource allocation.

Compound Moves: Systematic Value Multiplication for Digital Portfolios

Compound Moves demonstrate portfolio value creation through systematic optimization that compounds across interconnected digital assets rather than hoping separate business units will somehow align through traditional resource allocation.

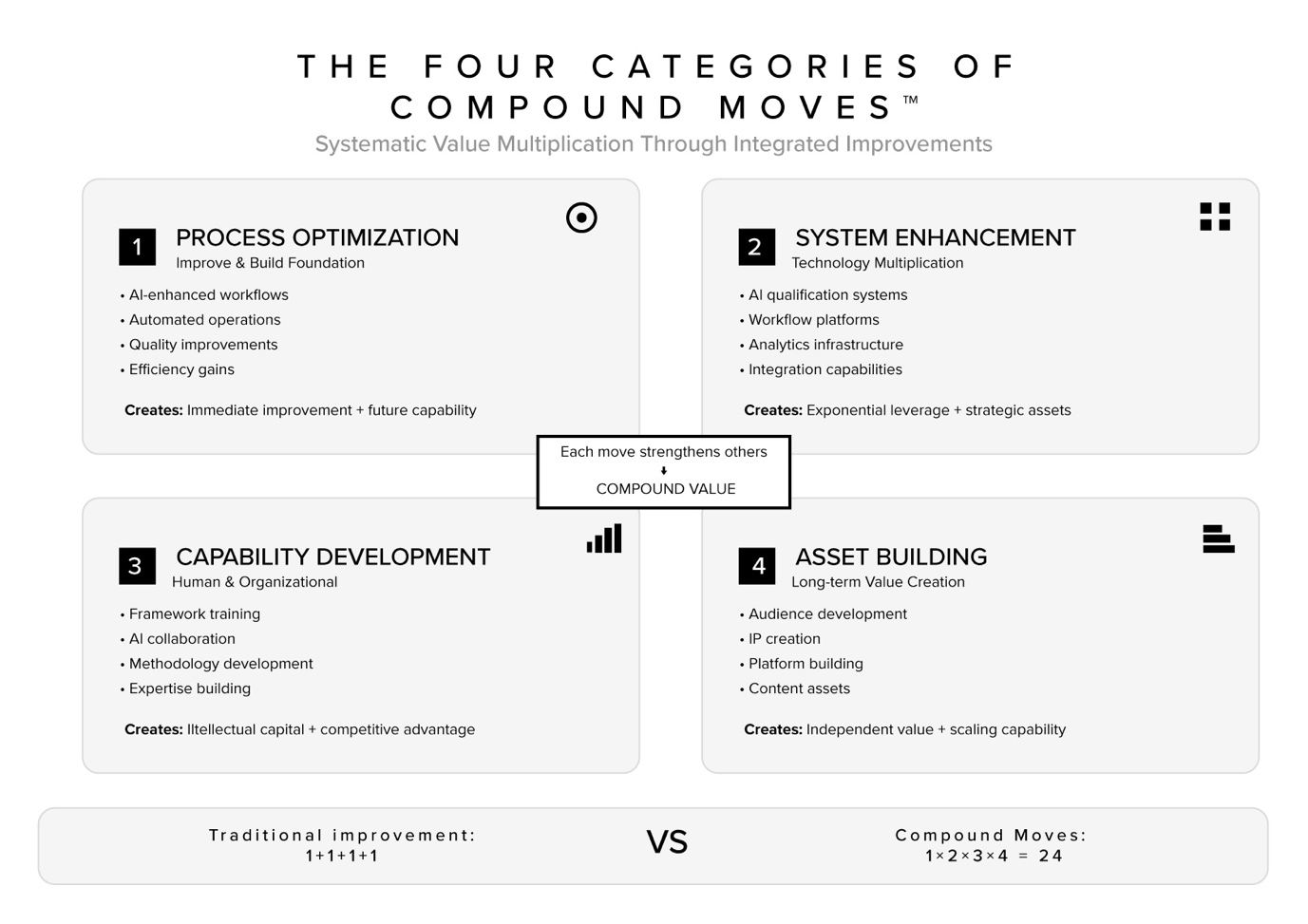

The Four Categories of Compound Moves for Portfolio Development

1. Process Optimization Compound Moves

Purpose: Systematically improve existing operations while building capabilities for future transformation Portfolio insight: Creates immediate value while developing foundation for exponential growth

Digital Portfolio Examples:

- Content Business: AI-enhanced writing workflows that improve quality while building audience intelligence

- Service Business: Automated client onboarding that improves experience while capturing behavioral data

- E-commerce: Predictive inventory optimization that reduces costs while improving customer satisfaction

Compound Characteristics:

- Immediate performance improvement in existing operations

- Systematic capability building for future strategic moves

- Data and process assets that enable further optimization

- Foundation creation for transformational initiatives

2. System Enhancement Compound Moves

Purpose: Implement technological capabilities that multiply existing value while enabling new possibilities Portfolio insight: Transforms traditional operations into digital-first systems with compound potential

Enhancement Architecture Examples:

- AI qualification systems: Improve lead quality while building customer intelligence database

- Automated workflow platforms: Increase efficiency while creating systematic optimization capability

- Data analytics infrastructure: Improve decision-making while building predictive intelligence assets

System Integration Benefits:

- Exponential improvement in existing processes through technological leverage

- Creation of strategic assets (data, algorithms, processes) with compound value

- Foundation for systematic optimization across entire portfolio

- Capability building that enables future transformation initiatives

3. Capability Development Compound Moves

Purpose: Systematically build human and organizational capabilities that create lasting competitive advantage Portfolio insight: Develops intellectual capital that compounds across all business activities

Capability Building Examples:

- Strategic Architecture framework training: Enhances team strategic thinking while improving client delivery

- AI-human collaboration protocols: Improves productivity while building future-ready capabilities

- Systematic methodology development: Improves service quality while creating proprietary intellectual property

Compound Development Effects:

- Enhanced performance across all current business activities

- Intellectual capital creation that differentiates market position

- Systematic improvement capability that compounds over time

- Foundation for premium positioning and pricing power

4. Asset Building Compound Moves

Purpose: Create strategic assets that generate long-term value while supporting immediate business objectives Portfolio insight: Builds wealth-generating assets that provide strategic independence and scaling capability

Asset Creation Examples:

- Audience development: Content strategy that builds marketing asset while demonstrating expertise

- Intellectual property creation: Framework development that improves delivery while creating licensing opportunities

- Platform development: Technology infrastructure that improves operations while enabling new business models

Asset Compound Value:

- Independent value generation beyond primary business activities

- Strategic leverage for expansion and transformation initiatives

- Competitive protection through unique asset ownership

- Long-term wealth creation through appreciating digital assets

BCG Growth-Share Matrix vs Compound Moves: The Portfolio Strategy Comparison

| Element | BCG Growth-Share Matrix | Compound Moves |

|---|---|---|

| Analysis Focus | Static market position categorization | Dynamic value multiplication through systematic optimization |

| Resource Allocation | Based on current market share and growth rates | Based on compound potential and system integration capability |

| Investment Logic | Fund stars, harvest cash cows, selectively bet on question marks | Systematic improvement that creates exponential value across portfolio |

| Value Creation | Portfolio balance through resource transfers | Compound effects where each improvement strengthens the entire system |

| Risk Management | Diversification across market positions | Protection through systematic capability building and asset creation |

| Strategic Direction | Maintain competitive position in attractive markets | Transform entire portfolio through systematic digital asset development |

| Success Measurement | Market share and financial returns per business unit | Compound value creation and systematic capability enhancement |

BCG matrix template vs compound moves framework comparison showing systematic value multiplication

Portfolio Transformation: Before vs After

Before: Traditional BCG Portfolio Analysis

Portfolio Assessment Matrix

Cash Cows (High Share, Low Growth):

- Legacy consulting services: €2M revenue, 15% margins

- Established client relationships: 80% retention rate

- Proven delivery methodologies: Standard market positioning

Stars (High Share, High Growth):

- Digital transformation consulting: €800K revenue, 25% growth

- Competitive market position: Top 3 in local market

- High investment requirement: €200K annually for team scaling

Question Marks (Low Share, High Growth):

- AI implementation services: €150K revenue, uncertain demand

- Unclear competitive position: New market with undefined standards

- High risk investment: €100K required for capability development

Dogs (Low Share, Low Growth):

- Basic website development: €80K revenue, declining margins

- Commoditized service offering: Price-based competition

- Recommendation: Divest or minimize investment

Why this misses transformation opportunity: Focuses on resource allocation between separate business units without recognizing systematic value multiplication potential.

After: Compound Moves Portfolio Architecture

Portfolio Compound System Design

Process Optimization Compound Moves: ✓ AI-enhanced consulting delivery increases efficiency 40% while building AI expertise ✓ Automated client reporting improves satisfaction while capturing behavioral intelligence ✓ Systematic methodology documentation improves quality while creating IP assets

System Enhancement Compound Moves: • AI-powered client analysis tools improve outcomes while building technology capability • Predictive project management reduces risk while developing systematic optimization • Client success automation improves retention while creating scalable delivery systems

Capability Development Compound Moves: • Team AI collaboration training improves all services while building transformation expertise • Strategic Architecture framework adoption enhances client value while differentiating position • Innovation methodology development improves outcomes while creating thought leadership

Asset Building Compound Moves: • Content strategy builds audience asset while demonstrating expertise to prospects • Framework IP creation improves delivery while generating licensing opportunities • Technology platform development improves operations while enabling new business models

Portfolio Compound Results: • Legacy consulting transforms into premium strategic advisory through AI enhancement • Digital transformation becomes category leadership through systematic methodology • AI services evolve from «question mark» to market-defining capability through compound development • Website development becomes platform opportunity through systematic technology building

Why this creates exponential value: Each Compound Move strengthens the others, creating systematic momentum where traditional «cash cows» evolve into strategic assets and «question marks» become momentum generators through integrated development.

The Four Stages of Compound Portfolio Evolution

Stage 1: Foundation Building (Months 1-6)

Objective: Establish systematic improvement capability across existing portfolio

Compound Moves Implementation:

- Process optimization in highest-volume activities for immediate improvement

- System enhancement through AI tool integration for capability building

- Team capability development through strategic framework training

- Documentation and methodology development for asset creation

Success Criteria: Measurable improvement in existing operations plus systematic capability building evidence

Stage 2: Integration Development (Months 6-18)

Objective: Create systematic connections between portfolio elements for compound value

Compound Moves Integration:

- Cross-portfolio process optimization that improves all business units simultaneously

- Technology platform development that enhances multiple service offerings

- Intellectual property creation that differentiates entire portfolio positioning

- Client intelligence systems that improve outcomes across all engagements

Success Criteria: Evidence of compound effects where improvements in one area systematically benefit others

Stage 3: Momentum Creation (Months 18-36)

Objective: Transform traditional «question marks» into momentum-generating strategic assets

Compound Moves Acceleration:

- Strategic asset deployment for new market creation and category definition

- Platform capabilities enabling new business models and revenue streams

- Thought leadership assets creating premium positioning and pricing power

- Technology infrastructure enabling systematic scaling and transformation

Success Criteria: Traditional BCG «question marks» becoming highest-value portfolio components through compound development

Stage 4: Portfolio Transformation (Months 36+)

Objective: Achieve systematic value multiplication across integrated digital asset portfolio

Compound Moves Mastery:

- Complete portfolio integration where each element strengthens others systematically

- Strategic asset portfolio generating independent value streams and strategic leverage

- Market position evolution from service provider to category-defining platform

- Systematic innovation capability creating continuous competitive advantage

Success Criteria: Portfolio generating exponential value through compound effects rather than linear resource allocation

Common Compound Moves Portfolio Development Mistakes

Mistake 1: Treating Compound Moves as Isolated Improvements

Wrong approach: Implement Compound Moves as separate optimization initiatives Correct approach: Design systematic integration where each move strengthens portfolio-wide capabilities

Mistake 2: Focusing Only on Process Optimization Without Asset Building

Wrong approach: Emphasize immediate efficiency gains without creating long-term strategic assets Correct approach: Balance immediate improvements with systematic asset development for compound value creation

Mistake 3: Traditional ROI Analysis for Compound Investments

Wrong approach: Evaluate Compound Moves using isolated return calculations Correct approach: Assess systematic value multiplication and portfolio-wide compound effects

Mistake 4: Sequential Implementation Instead of Integrated Development

Wrong approach: Complete one Compound Move before starting others Correct approach: Implement integrated Compound Moves that strengthen each other through simultaneous development

BCG Growth-Share Matrix vs Compound Moves: What Portfolio Strategy Really Needs in 2025

Beyond Static Analysis: Dynamic Asset Architecture

2025 portfolio strategy priorities:

- Systematic value multiplication over static resource allocation between business units

- Compound asset development over traditional market position analysis

- Integrated portfolio evolution over isolated business unit optimization

- Digital transformation momentum over cash cow vs star categorization

The AI-Era Portfolio Investment Thesis

Traditional portfolio logic: Balance resources across business units based on market position and growth rates 2025 portfolio logic: Create systematic value multiplication through Compound Moves that transform entire portfolio capabilities regardless of traditional market analysis

Why Compound Moves matter more: AI accelerates market transformation, making static portfolio categories obsolete quickly. Success requires systematic capability building that creates compound value rather than hoping traditional cash flow allocation will fund growth in changing markets.

Building Your Compound Portfolio Architecture

Compound Moves represent evolution beyond traditional BCG Growth-Share Matrix toward systematic value multiplication that creates exponential portfolio returns through integrated digital asset development rather than hoping static business unit analysis will guide resource allocation.

Whether you’re managing a service business portfolio or building digital asset strategies, Compound Moves provide the framework for creating systematic value multiplication through process optimization, system enhancement, capability development, and strategic asset building that compounds across your entire portfolio.

The choice: Continue categorizing business units into static BCG portfolio boxes hoping resource allocation will create growth, or implement Compound Moves that systematically multiply value through integrated digital asset architecture.

Get Compound Moves implementation frameworks and complete Strategic Architecture™ methodology delivered weekly → Subscribe to our Substack newsletter for systematic portfolio development and compound value creation techniques that build exponential business value.

Join thousands of business leaders learning to create systematic value multiplication through compound asset development rather than hoping traditional portfolio analysis will guide digital transformation.

Prepared by the Strategic Architecture™ Editorial Team, bringing clarity to the frameworks shaping the AI era.

BCG Matrix categorizes business units into static boxes (cash cow vs star) for resource allocation. Compound Moves create systematic value multiplication through integrated improvements that compound across the entire portfolio. Instead of «fund stars from cash cows,» you build systematic capabilities that transform all portfolio elements simultaneously.

Yes, but prioritize Compound Moves for value creation, then support with BCG analysis for resource planning. Focus on systematic capability building first (proof of compound value), then use traditional analysis as supporting framework for specific allocation decisions.

Look for improvements that strengthen multiple portfolio elements simultaneously. Ask: «What optimization would improve current performance while building capabilities for future transformation?» Focus on process, system, capability, and asset building moves that create exponential rather than linear value.

Start with foundational Compound Moves in your strongest business unit and systematically build connections. «We’ve proven AI tools improve consulting delivery by 40%, now building AI expertise that enables transformation services across entire portfolio.» Demonstrate systematic thinking and integration progress.

Trademark Notice

© 2025 Edward Azorbo. All rights reserved.

Strategic Inevitability™, Strategic Architecture™, Compound Moves, Power Numbers™, Strategic Triggers™, Clear Paths™, Mathematical Freedom Recognition™, Trinity Framework™, and all related names, logos, and framework titles are trademarks or registered trademarks of Edward Azorbo in the United States, the European Union, and other jurisdictions.

Unauthorized use, reproduction, or modification of these marks and the proprietary methodologies they represent is strictly prohibited. All other trademarks and trade names are the property of their respective owners.