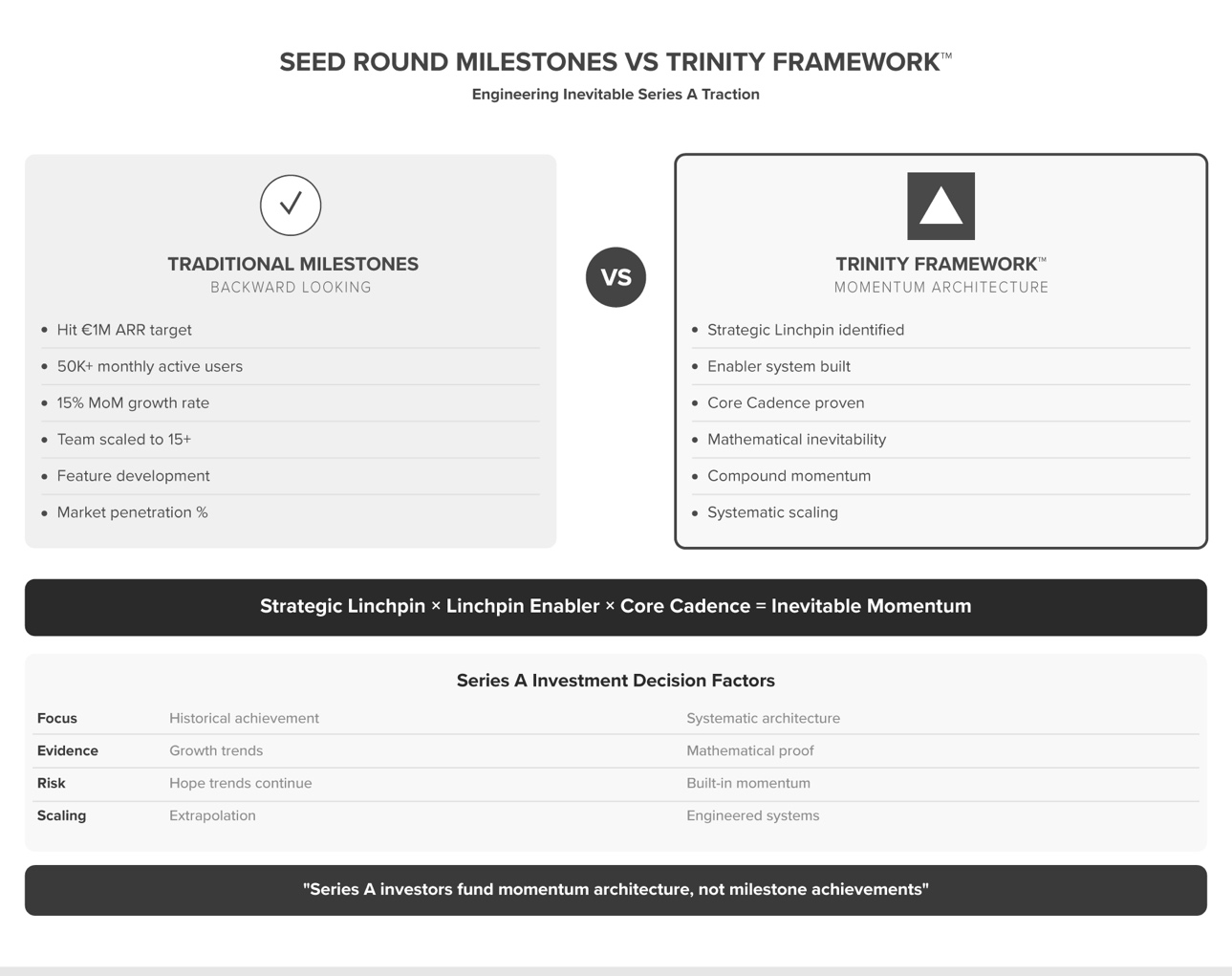

Seed Round Milestones vs Trinity Framework™: Engineering Inevitable Series A Traction

Seed-round milestones track historic progress; Trinity Framework™ combines Linchpin × Enabler × Cadence to engineer momentum that makes Series A funding mathematically inevitable.

Traditional seed round milestones focus on backward-looking performance metrics like user growth, revenue targets, and market traction without demonstrating systematic scaling architecture. But how to raise Series A funding in 2025 requires proof of inevitable momentum rather than hoping historical trends continue.

Trinity Framework™ replaces milestone-based fundraising with systematic momentum engineering: Strategic Linchpin × Linchpin Enabler × Core Cadence creates pre-packaged traction that makes Series A investment mathematically inevitable.

How to Raise Series A in 2025: Trinity Framework vs Milestone Playbook

The Seed Round Milestones Problem: Why Series A Investors See Through Traditional Metrics

Most founders present Series A readiness through conventional seed round progression: hit revenue targets, achieve user milestones, demonstrate market validation, and show team scaling capability. This milestone-driven approach creates three critical Series A fundraising failures:

1. Milestone Achievement vs Momentum Architecture

Traditional seed round approach:

- Hit €1M ARR target from €100K seed stage

- Achieve 50K+ monthly active users

- Demonstrate 15%+ month-over-month growth

- Build team from 3 to 15+ employees

Series A reality check: Hitting milestones doesn’t prove systematic scaling capability. VCs have seen countless startups achieve impressive seed targets only to plateau or struggle with operational complexity.

When market conditions change or competitive pressure increases, milestone-based businesses often lose momentum because they built achievement rather than architecture.

2. Historical Performance vs Inevitable Trajectory

Standard seed round metrics:

- Revenue growth rate trends over 12-18 months

- Customer acquisition cost improvements

- Market penetration percentages

- Team productivity and scaling metrics

Investment insight problem: Historical milestone achievement shows what happened under specific conditions but doesn’t prove the business has built systematic momentum that will continue regardless of external factors or competitive pressure.

3. Disconnected Metrics vs Integrated System

Traditional Series A readiness indicators:

- Individual metric optimization across different areas

- Isolated performance improvements in revenue, users, operations

- Competitive positioning based on feature development

- Market opportunity sizing and capture rates

Scaling reality: Series A success depends on systematic momentum architecture where core business elements work together to create inevitable traction rather than hoping disconnected improvements will somehow align.

How Traditional Seed Round Milestones Miss Series A Investment Readiness

Research from First Round Capital’s 2024 State of Startups report shows that 65% of Series A failures involved startups with strong traditional seed metrics that couldn’t demonstrate systematic momentum architecture. According to 2024 VC benchmark data, companies that focused purely on milestone achievement showed plateau problems invisible in traditional performance tracking.

Real-World Seed Round vs Trinity Framework Examples

Traditional Seed Round: B2B SaaS Platform (Failed Series A)

Series A Pitch: Milestone Achievement

- Revenue Growth: €100K to €1.2M ARR over 18 months

- Customer Growth: 500 to 5,200 active accounts

- Team Scaling: 4 to 18 employees across all functions

- Market Penetration: 3% of addressable market captured

- Product Development: 47 new features shipped

Why Series A investors passed: Strong milestone achievement but no proof of systematic momentum. When growth slowed and operational complexity increased, the business revealed it had hit targets without building momentum architecture.

The company couldn’t demonstrate that scaling would continue beyond current conditions or competitive pressures.

Trinity Framework Alternative: Systematic Momentum Engineering

Trinity Framework Architecture:

Strategic Linchpin: Customer Success as the ONE element that powers everything

- Customer retention creates predictable revenue base

- Successful customers become acquisition engine through referrals

- Product development priorities driven by usage analytics

- Team scaling guided by customer success capacity needs

Linchpin Enabler: AI-powered customer success optimization system

- Automated onboarding reduces time-to-value by 60%

- Predictive analytics identify at-risk accounts 48 hours early

- Usage pattern analysis drives product roadmap decisions

- Success manager productivity increased 3x through AI assistance

Core Cadence: Weekly customer success optimization rhythm

- Monday: Analyze weekend usage patterns and engagement drops

- Tuesday: Implement targeted interventions for at-risk accounts

- Wednesday: Test new onboarding optimizations with subset of users

- Thursday: Analyze intervention results and document learnings

- Friday: Plan next week’s optimization focus and system improvements

Why this gets Series A funding: Demonstrates systematic momentum architecture where customer success improvements automatically drive revenue growth, product development, and operational scaling. Creates mathematical inevitability rather than hoping milestone trends continue.

The Momentum Blindness Problem

Slack’s Pre-Series A Story (2013):

- Traditional milestones achieved: 15K daily active users, $1M ARR run rate, enterprise customer adoption

- What traditional metrics missed: The systematic momentum architecture that enabled exponential viral growth and inevitable market dominance

Trinity Framework approach would have emphasized:

- Strategic Linchpin: Team communication as the core value driver that powers everything

- Linchpin Enabler: Viral growth architecture built into core product experience

- Core Cadence: Daily product iteration based on usage patterns and team feedback loops

Investment insight: Slack’s Series A success came from systematic momentum architecture that made growth inevitable, not from achieving traditional milestone targets or market sizing projections. This demonstrates how to raise Series A through engineered traction rather than milestone extrapolation.

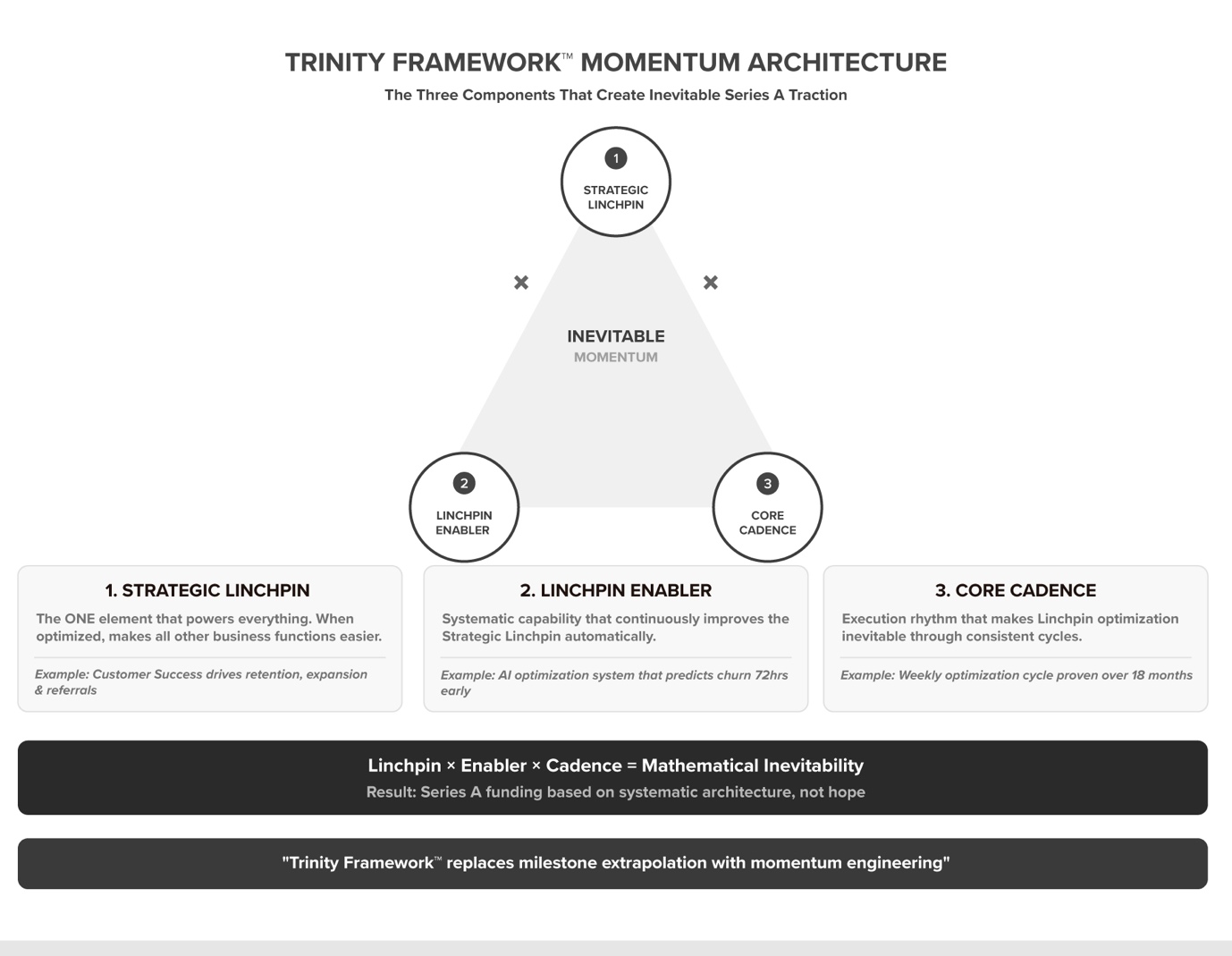

Trinity Framework™: Engineering Inevitable Series A Traction

Trinity Framework demonstrates Series A readiness through systematic momentum architecture that proves scaling inevitability rather than hoping milestone achievements will translate to continued growth.

The Three Components of Series A Momentum Architecture

1. Strategic Linchpin: The ONE Element That Powers Everything

Purpose: Identify the single foundational element that enables all other business functions Series A insight: Mathematical confidence in systematic scaling rather than multi-variable optimization hope

Series A-Ready Linchpin Examples:

- B2B SaaS: Product stickiness (drives retention, reduces CAC, enables expansion revenue)

- Marketplace: Transaction volume velocity (creates network effects, improves unit economics, enables monetization)

- E-commerce: Customer lifetime value optimization (funds acquisition, enables inventory investment, drives platform improvements)

Linchpin Validation Questions:

- What ONE element, if optimized, makes everything else easier?

- What creates mathematical freedom for strategic choices?

- What enables compound moves throughout the system?

- What protects the business from external volatility?

2. Linchpin Enabler: The System That Optimizes the Linchpin

Purpose: Build systematic capability that continuously improves the core strategic element Series A insight: Evidence of architectural thinking rather than manual optimization

Enabler Architecture Examples:

- Product stickiness enabler: AI-driven feature adoption optimization system

- Transaction velocity enabler: Automated matching and recommendation engine

- LTV optimization enabler: Predictive analytics platform for customer behavior

Enabler Characteristics:

- Systematic rather than manual improvement capability

- Data-driven optimization that compounds over time

- Architectural investment that creates lasting competitive advantage

- Automation that scales without proportional resource increases

3. Core Cadence: The Rhythm That Makes It Inevitable

Purpose: Create systematic execution rhythm that ensures consistent progress toward Strategic Linchpin optimization Series A insight: Proof of disciplined execution architecture that can scale systematically

Cadence Architecture Examples:

- Weekly optimization cycles: Monday analysis → Tuesday implementation → Wednesday testing → Thursday validation → Friday planning

- Daily improvement rhythms: Morning system analysis → Afternoon intervention deployment → Evening results capture

- Monthly capability building: Systematic enhancement of Linchpin Enabler systems and processes

Cadence Success Indicators:

- Binary execution consistency (either in cadence or not)

- Measurable improvement in Strategic Linchpin performance

- Systematic capability building rather than random activity

- Compound effect acceleration over time

Trinity Framework vs Traditional Seed Round Metrics: The Series A Comparison

| Element | Traditional Seed Round Milestones | Trinity Framework |

|---|---|---|

| Focus | Historical milestone achievement | Systematic momentum architecture |

| Evidence | Growth trends and target completion | Mathematical inevitability proof |

| Scaling | Hoping trends continue at higher volume | Engineered systems that compound automatically |

| Risk Assessment | Market and competitive analysis | Built-in momentum protection and early warning systems |

| Investment Rationale | Trajectory extrapolation | Architectural proof that enables predictable scaling |

| Team Scaling | Hiring to support growth | Systematic capability building that reduces human dependencies |

| Competitive Advantage | Feature development and market positioning | Momentum architecture that creates systematic advantages |

Series A Slide Transformation: Before vs After

Before: Traditional Seed Round Milestone Presentation

Slide 6: Traction & Milestones

Revenue Growth: €100K → €1.4M ARR (18 months) Customer Growth: 500 → 6,200 active accounts (+1,140% growth) Market Penetration: 4.2% of €35M addressable market Team Scaling: 4 → 22 employees across engineering, sales, marketing Product Development: 52 features shipped, 3 major platform releases Customer Metrics: 92% satisfaction score, 8% monthly churn

Why this fails for Series A: Shows historical achievement but no proof that momentum will continue. Doesn’t demonstrate systematic architecture that can scale beyond current conditions.

After: Trinity Framework Momentum Architecture Presentation

Slide 6: Systematic Momentum Architecture

Strategic Linchpin – Customer Success Powers Everything ✓ 95% feature adoption within 30 days drives 3% churn vs 15% baseline ✓ Successful customers generate 2.3x revenue expansion within 12 months ✓ Net Promoter Score >70 creates 40% of new customer acquisitions through referrals

Linchpin Enabler – AI Customer Success Optimization System • Predictive analytics identify at-risk accounts 72 hours before churn signals • Automated intervention workflows increase retention 60% vs manual approach • Usage pattern analysis drives product roadmap with 85% accuracy on feature adoption • Success manager productivity: 45 accounts per manager vs 15 industry standard

Core Cadence – Weekly Optimization Rhythm (18 months proven) • Monday: Customer health analysis and risk identification • Tuesday-Wednesday: Deploy targeted interventions and product optimizations • Thursday: Validate results and capture systematic learnings • Friday: Plan next week’s improvements and system enhancements

Momentum Proof • Customer success improvements automatically drive revenue growth (correlation: 0.94) • System enables 3x team scaling without proportional overhead increases • Competitive advantage compounds weekly through systematic optimization • Momentum protected through early warning systems and automated responses

Why this gets Series A funding: Demonstrates mathematical proof that momentum will continue regardless of external conditions. Shows systematic architecture that makes scaling inevitable rather than hoping current trends persist.

This approach gives investors confidence in Series A metrics investors want: predictable momentum rather than historical achievement extrapolation.

The Five Stages of Trinity Framework Series A Preparation

- Linchpin Identification (Months 1-3 post-seed)

Objective: Identify the ONE element that powers everything in your business

Activities: Analyze which business elements create the most leverage, test correlation between different metrics and overall business performance, validate which optimizations make everything else easier, document mathematical relationships between core element and business outcomes

Success Criteria: Clear identification of Strategic Linchpin with mathematical validation

- Enabler Architecture Design (Months 4-8 post-seed)

Objective: Build systematic capability that optimizes your Strategic Linchpin

Activities: Design systems that improve Linchpin performance automatically, implement data collection and analysis infrastructure, create optimization workflows that compound over time, test systematic improvements vs manual interventions

Success Criteria: Functioning Linchpin Enabler system showing measurable improvement acceleration

- Cadence Establishment (Months 6-12 post-seed)

Objective: Create execution rhythm that makes Linchpin optimization inevitable

Activities: Establish weekly optimization cycles with clear activities, build measurement systems that track cadence effectiveness, create capability building routines within cadence structure, validate consistency and compound effect acceleration

Success Criteria: Proven cadence delivering systematic improvement over 6+ months

- Momentum Validation (Months 10-15 post-seed)

Objective: Prove that Trinity Framework™ creates inevitable momentum

Activities: Document mathematical relationship between cadence and business outcomes, test system resilience under different market conditions, validate that momentum continues without manual intervention, demonstrate compound effect acceleration over time

Success Criteria: Mathematical proof that system creates inevitable momentum

- Series A Readiness (Months 15-18 post-seed)

Objective: Present systematic momentum architecture to Series A investors

Activities: Package Trinity Framework™ evidence for investor presentation, demonstrate mathematical inevitability of continued traction, show systematic scaling capability beyond current conditions, prove momentum protection and risk mitigation architecture

Success Criteria: Series A funding based on momentum architecture proof rather than milestone extrapolation

Common Trinity Framework Series A Presentation Mistakes

- Presenting Trinity as Another Milestone

Wrong approach: Show Trinity Framework™ components as achievements to check off Correct approach: Emphasize systematic momentum architecture that makes scaling inevitable

- Focusing Only on Linchpin Without System Integration

Wrong approach: Highlight Strategic Linchpin optimization without showing Enabler and Cadence architecture Correct approach: Demonstrate complete system that creates compound momentum through integrated components

- Theoretical Framework Without Execution Proof

Wrong approach: Present Trinity Framework concepts without demonstrated results Correct approach: Show systematic evidence of momentum creation and acceleration over time

- Complex Systems Instead of Clear Architecture

Wrong approach: Overcomplicate Trinity components with unnecessary complexity Correct approach: Simple, clear architecture that anyone can understand and validate effectiveness

Seed Round Milestones vs Trinity Framework: What Series A Investors Really Want

Beyond Milestone Achievement: Architectural Evidence

Series A investor priorities in 2025:

- Systematic momentum architecture over historical growth extrapolation

- Mathematical inevitability proof over trend line projections

- Compound system validation over individual metric optimization

- Momentum protection systems over competitive advantage claims

The AI-Era Series A Investment Thesis

Traditional Series A logic: Fund startups that have hit milestones in large markets with strong teams 2025 Series A logic: Fund startups that have built systematic momentum architecture proving inevitable traction regardless of external conditions

Why Trinity Framework matters more: AI accelerates market change, making historical milestone achievement less predictive of future success. Investors need mathematical proof that momentum will continue systematically rather than hoping current trends persist. This shift explains how to raise Series A funding in an environment where Series A metrics investors want focus on systematic architecture over historical performance.

Engineering Your Series A Story

Trinity Framework represents evolution beyond traditional seed round milestone tracking toward systematic momentum engineering that demonstrates inevitable Series A traction rather than hoping historical performance indicates future success.

Whether you’ve recently closed seed funding or are preparing for Series A, Trinity Framework provides the architecture for engineering inevitable momentum through systematic Strategic Linchpin optimization powered by Enabler systems and executed through consistent Core Cadence.

The choice: Continue tracking traditional seed round milestones hoping investors extrapolate future success, or engineer Trinity Framework momentum architecture that proves Series A traction inevitability.

Get Trinity Framework implementation guides and complete Strategic Architecture methodology delivered weekly → Subscribe to our Substack newsletter for momentum engineering and systematic traction techniques that get Series A funded.

Join thousands of founders learning to engineer inevitable Series A readiness through momentum architecture rather than hoping milestone achievements continue.

Prepared by the Strategic Architecture Editorial Team, bringing clarity to the frameworks shaping the AI era.

Beyond ARR and user growth, investors look for systematic momentum architecture that proves inevitable traction. Trinity Framework demonstrates this through Strategic Linchpin optimization, systematic Enabler capabilities, and consistent Core Cadence execution that creates mathematical predictability rather than hoping trends continue.

It replaces one-off milestones with systematic momentum engineering. Instead of «we hit €1M ARR,» you show «our customer success architecture automatically drives revenue growth with 94% correlation.» This gives investors confidence in systematic scaling rather than historical performance extrapolation.

Yes, but lead with Trinity Framework momentum architecture, then support with milestone achievements as evidence. Show systematic inevitability first (proof of engineered traction), then historical performance as supporting validation that demonstrates Series A metrics investors want.

Ask: «What ONE element, if optimized, makes everything else easier?» Test correlations between different business elements and overall performance. Your Linchpin is what creates mathematical freedom, enables compound moves, and protects against volatility.

Start with Linchpin identification and show systematic progress. «We’ve proven customer success drives 94% correlation with revenue growth, building AI optimization system that accelerates this 3x.» Demonstrate architectural thinking and systematic implementation progress toward how to raise Series A through momentum rather than milestones.

Trademark Notice

© 2025 Edward Azorbo. All rights reserved.

Strategic Inevitability, Strategic Architecture, Trinity Framework, Power Numbers, Strategic Triggers, Clear Paths, Mathematical Freedom Recognition, and all related names, logos, and framework titles are trademarks or registered trademarks of Edward Azorbo in the United States, the European Union, and other jurisdictions.

Unauthorized use, reproduction, or modification of these marks and the proprietary methodologies they represent is strictly prohibited. All other trademarks and trade names are the property of their respective owners.